Detailed Methodologies

The credit rating methodologies describe FiinRatings' approach to assessing the credit risk of issuers and debt instruments, as well as explain in detail how FiinRatings evaluates the factors in the credit rating framework for different entities.

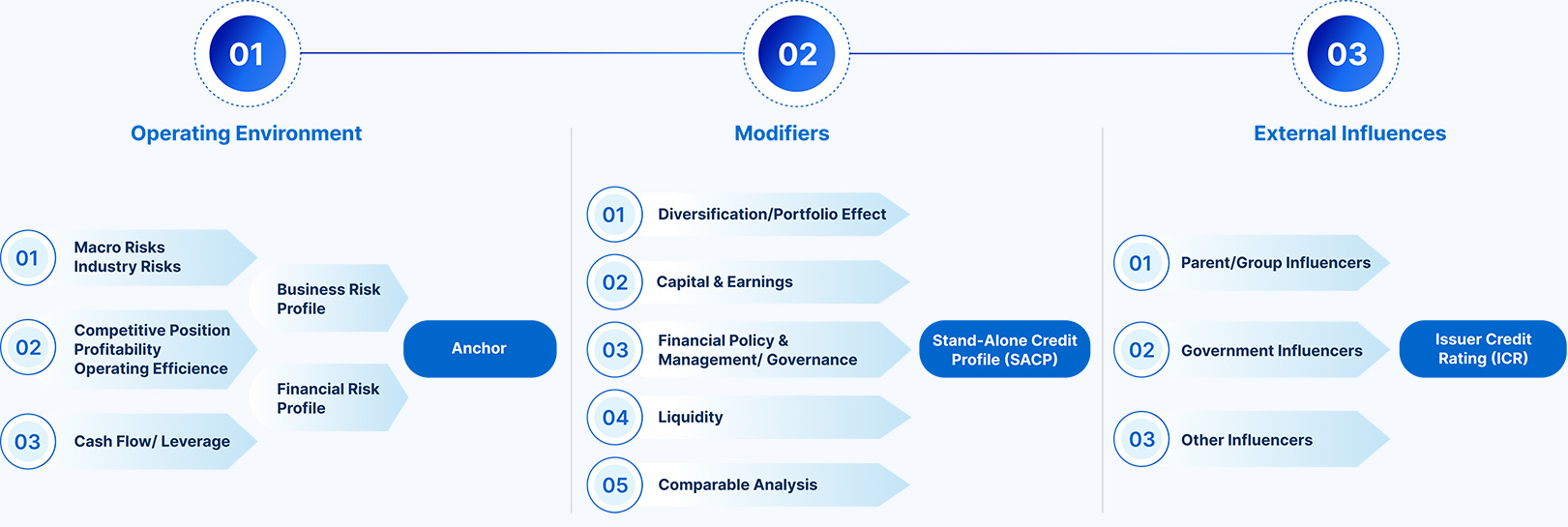

Issuer Credit Rating

Anchor: determined by combining the evaluation of the business risk profile and the financial risk profile of the issuer (for non-financial companies), or the evaluation of general industry risk factors (for financial institutions).

Stand-Alone Credit Profile (“SACP”): determined by adjusting the anchor for the impacts of modifiers. The analysis of these modifiers can upgrade, downgrade, or have no effect on the anchor.

Issuer Credit Rating (“ICR”): is the result of a combination of the SACP and external influences, such as the support from Government or Parent Company.

Issue Credit Rating

The effective period of an Issue Credit Rating depends on the tenor of the debt instrument. Short-term is understood as less than 1 year, medium-term from 1-5 years, long-term over 5 years. The issue credit rating score is monitored and updated based on the financial situation, liquidity risks of the Issuer and factors affecting solvency when financial obligations are due.

When conducting Issue Credit Rating, FiinRatings makes adjustments to upgrade or downgrade from the Issuer Credit Rating, depending on the impacts of specific factors related to debt instruments, such as financial covenants, collateralized assets, priority order of debt repayment…

General Rating Framework

Rating framework for non-financial companies

Rating framework for financial institutions

Credit Rating Methodology

| Content | Updated as of | Detail |

|---|---|---|

| Treatment of Non-Common Equity Financing for Nonfinancial Corporate Entities | 06/2025 | Access here |

| Criteria For Assigning 'CCC+', 'CCC’, 'CCC-', And 'CC' Ratings | 06/2025 | Access here |

| Project Finance Methodology | 07/2024 | Access here |

| Issue Rating Methodology | 11/2025 | Access here |

| Methodology for notching the standalone ratings of subsidiaries for group support | 10/2025 | Access here |

| Banks Rating Methodology | 04/2025 | Access here |

| Securities Companies Credit Rating Methodology | 01/2022 | Access here |

| Non-Bank Finanancial Companies | 01/2022 | Access here |

| Corporate Credit Rating Methodology | 08/2025 | Access here |

| Rating Framework, Symbols and Definitions | 05/2020 | Access here |